Is an ERP really necessary for small to medium-sized businesses?

Well, the answer is not always. However, for most business the answer is yes, ERP still is worth considering, even if you are happy with financial management using basic accounting software like Tally, QuickBooks or Zoho. For most small businesses, it often makes good sense to get started with such accounting software. They are good enough to handle their financial management needs and are more cost effective than ERP systems. Over the years, many accounting tools have grown in features and capabilities, expanding themselves to include more advanced functionalities such as integrated payroll, invoicing, payments, quotes, purchase orders, and some inventory management – features that previously were the exclusive domain of ERP systems.

Moreover, now with the trend of cloud-hosted applications, it’s possible to augment the capabilities of accounting software even more through integrations with third-party programs. With the expanded features and integrations available, it can be quite difficult to draw a line between a small business accounting software and a full-blown ERP, leaving the decision-makers at sea. But the catch is on how comprehensive the features are and how to separate apps put together with help in the growth of the company. In this blog, we bring to you the major differences in capabilities of an ERP system and accounting software, so that you can choose the system that best meets your business needs.

What is an Accounting Software?

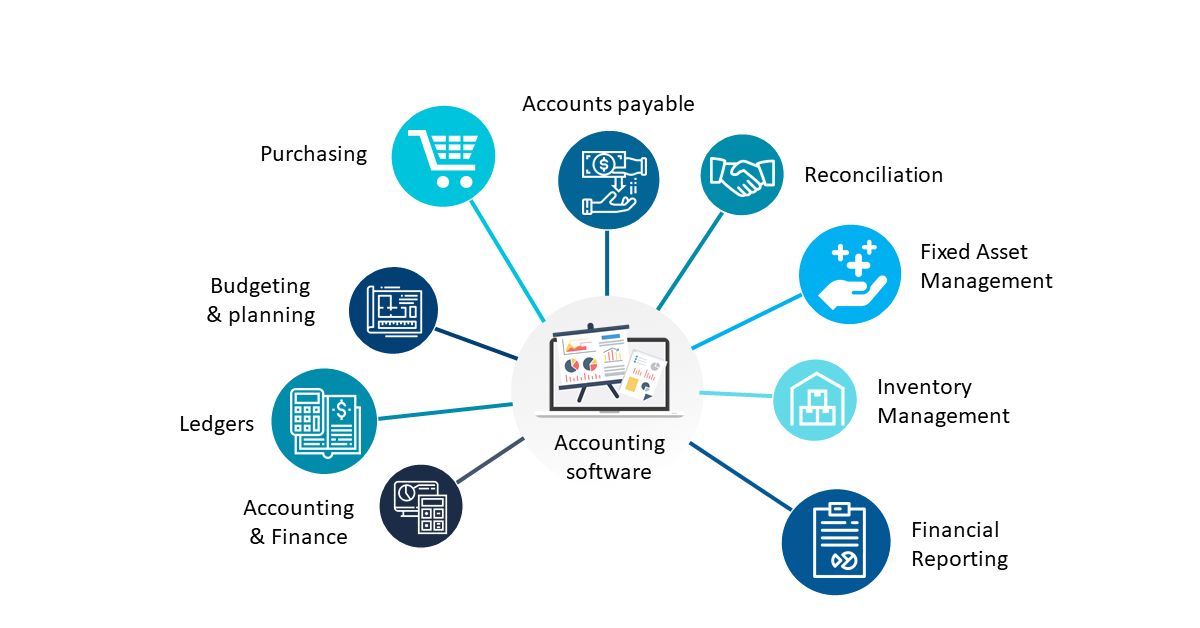

The primary purpose of accounting software is to record financial transactions. It can handle the financial or accounting requirements of a small business such as General Ledger, Accounts Payable, Accounts Receivable, Cash Management, Bank Reconciliations, etc and to produce limited financial reporting such as Balance Sheets, Simplistic Cash Flow Reports, Income Statements, Profit & Loss Statements, etc. Some of the modern small business accounting software also provides modules that take care of invoicing, payables, and payroll. Few will also provide additional sales and ordering tools such as quotes and purchase orders as well as very simple inventory management. However, these functionalities are very limited and nowhere close to what an ERP system offers.

What is an ERP?

An ERP (Enterprise Resource Planning) system is a business process management software that manages and organizes a company’s business processes, all in a single integrated platform. The activities that can be managed using an ERP system include finance, sales, customer relationships, manufacturing, inventory management, supply chain management, HR, payroll, and more.

Basically, an ERP system packs up the whole of your organization into a single suite and equips you with all the information you need about your business activities through a common database accessed by all applications in the system. Hence, you no longer need multiple systems, that don’t talk to each other, to handle the different processes such as Accounting, HR, CRM, Supply Chain, etc. Isn’t that really cool?

ERP vs Accounting Software – The Differences

Now that we have seen the difference in functionalities of an ERP and Accounting software, you would understand that an accounting software essentially comprises just a subset of the features available in an ERP system. While an accounting system focuses mostly on financial accounting functions, ERP systems are scalable systems with functionalities that span across the organization. Hence, to directly compare an accounting software against an ERP software wouldn’t make sense; it’d be like comparing apples to oranges and asking which is better.

Like we already mentioned before, it is common for companies to start with an Accounting Software. But, once businesses start growing, they find themselves dealing with more complexities – like cross-referencing data, managing subsidiaries across various locations and multiple currencies, need to integrate finance with other business processes, and so on, which become difficult with small business accounting software.

Moreover, accounting software products tend to be quite generic out-of-the-box solutions with limited scope for configuration and customization. They can probably work well across a multitude of businesses provided that the business is prepared to alter its way of doing things and follow the processes offered by the software. Basic accounting software also has limited support for multi-entity, multi-currency transactions, security and compliance, handling huge volume transactions, etc.

To sum up, basic accounting software products are good enough to take care of the standard accounting functions, banking, and limited reporting of small businesses preferably for a single legal entity or location. However, they often fail to provide businesses’ the ability to manage more complex finance & accounting requirements and provide the integrated real-time visibility needed to gain insights for improving business process efficiency. To do your best, you need a fully integrated and overarching solution, a full-blown ERP, that can manage complex requirements, help you gain better control over entire business processes, make fast and accurate decisions, and scale quickly and effectively.

ERP vs Accounting Software – Which one should you choose?

The choice of an ERP over Accounting software depends on the nature of your business, complexities of business processes and so on. Accounting software solutions are normally suited for small businesses with limited IT support or business complexity. Whereas, ERP systems are perfect for organizations in need of an integrated system that supports expansion. Organizations in the growth path need to ensure that their IT investments can support their growth by incorporating solutions that can automate and streamline their finance and other business processes as well. The advent of Cloud ERPs and rapid implementation programs makes ERPs more affordable even for small businesses, without having to worry about the expenses and complexities associated with setting up the infrastructure. So, it would be worth investing in an ERP offering broader capabilities, scalability and agility after assessing the present and future needs of the business.

When Should You Upgrade from an Accounting Software to an ERP?

As your business grows, at some point, a small business accounting software would become insufficient to manage the growing business needs.

So, how do you know when it’s time to switch to an ERP? You will start spending more time in managing multiple systems and spreadsheets. Governance, compliance and risk monitoring becomes chaotic. These are just a few signs that it’s time to upgrade. Read more about the 6 signs that your business has outgrown the capabilities of an Accounting Software, in our whitepaper “Time to Rethink Accounting Software and Switch to an ERP?”.

When a business pushes an accounting system beyond its limits and avoids investing in a suitable business software at the right time, it in fact might cost the business by being unable to exploit opportunities for business growth and efficiency. So, although it makes sense to start with a basic accounting software, it is very important that you switch to an ERP when you start experiencing growing pains and your accounting software starts eating up your resources.

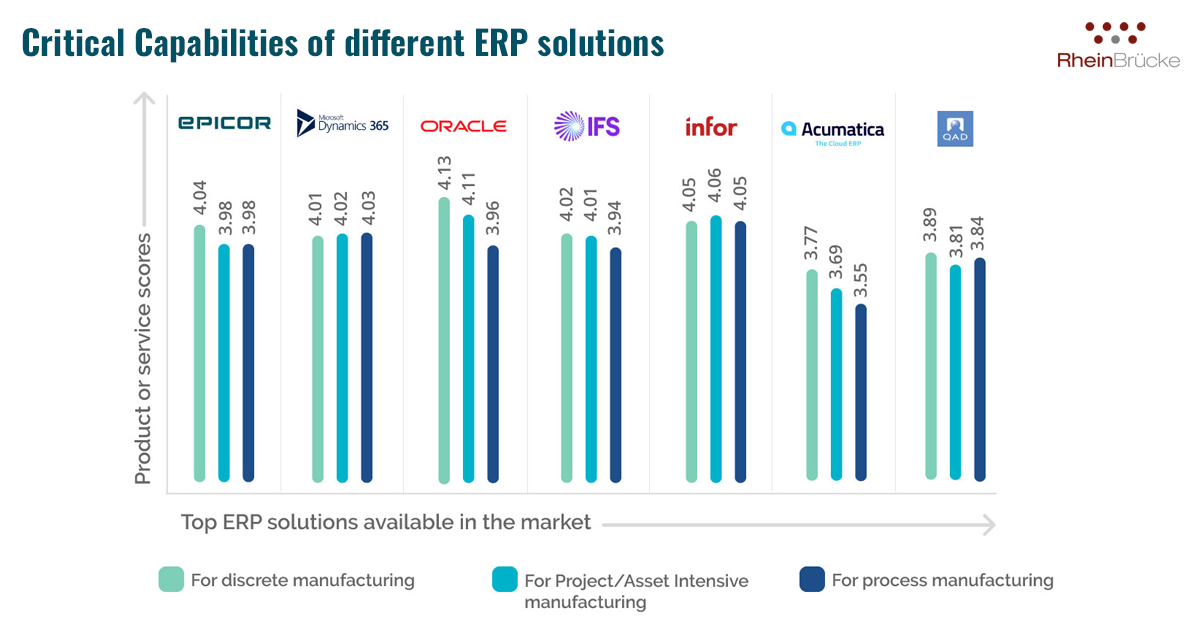

RheinBrücke partners with Epicor to provide flexible, industry-specific ERP solutions designed around the needs of various industries including discrete manufacturing, process manufacturing, EPC, oil & gas and more. Click here to know more about our ERP consultation and implementation services.

Time to Rethink Accounting Software and Switch to an ERP?

Related Blogs

- Top 7 ERP Software for 2025

- ERP Comparison – Epicor ERP vs SAP ERP

- Epicor vs NetSuite – Differences in Overheads

- Epicor ERP vs Microsoft Dynamics 365 – A Detailed Comparison

- 7 Essential Modules in ERP Systems